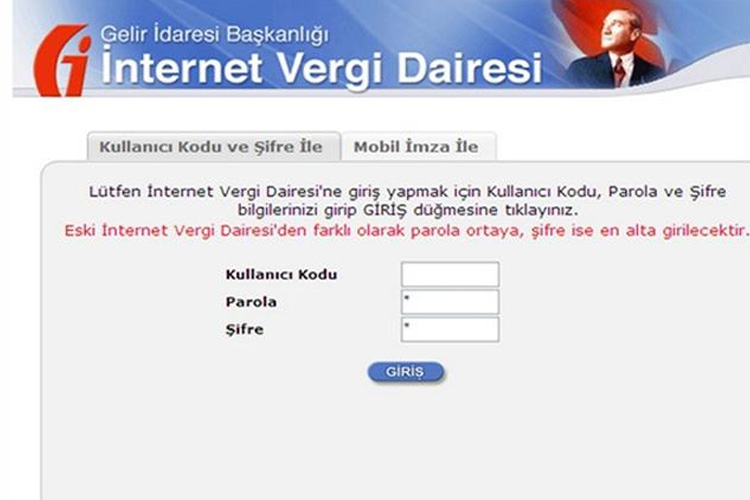

The Tax Identification Number (TIN) in Turkey, known as “Vergi Numarasi” in Turkish, is an official document.

required for various government and official transactions, especially for activities like establishing companies in Turkey.

opening a bank account, registering and paying utility bills, settling fees for Turkish residence permits, and applying.

for a Turkish driving license, as well as for property ownership in Turkey.

What does the Tax Identification Number (TIN) mean?

- The Tax Identification Number in Turkey is a unique nine-digit number issued to both Turkish citizens and foreigners

- It is obtained from the nearest Tax Office in Turkey and is used for various official local purposes.

How to obtain a Tax Identification Number in Turkey:

- To obtain a Tax Identification Number in Turkey, individuals, whether Turkish citizens or foreigners.

- should visit the nearest Tax Office in their residing area and present their passport. This number is crucial, and it is required for various official transactions.

What are the most common transactions requiring a Tax Identification Number in Turkey?

The Tax Identification Number is typically required for several transactions in Turkey, including:

- Opening a bank account in any Turkish bank, whether government or private.

- Establishing limited and unlimited companies in Turkey.

- Paying bills for electricity, water, gas, telephone, and internet services.

- Paying Turkish residence permit fees of various types.

- Owning all types of Turkish real estate to obtain the title deed.

- Applying for a Turkish driving license.

- Purchasing a vehicle and transferring its ownership to an individual’s name

Who doesn’t need to obtain a Tax Identification Number in Turkey?

Tourists visiting Turkey for several days under their existing visas, e-visas, or visa-on-arrival do not need to obtain a Tax Identification Number.

Does having a Tax Identification Number mean you have to pay taxes in Turkey?

- Not necessarily. The Tax Identification Number is primarily used for commercial and government.

- transactions and does not imply that an individual is subject to taxes in Turkey unless they engage in specific economic activities.

- Taxes in Turkey are imposed based on economic activities, such as establishing companies, property taxes when purchasing.

- real estate, and other types like value-added tax (VAT), annual taxes, etc.

العربية

العربية